People, whether they like it or not, live together. Although we may not always be aware of it, those who live in the present would find life unbearably inconvenient without others. This means that the quality of our lives depends on countless people we do not even know.

Most of what appears on our breakfast table has passed through the hands of many individuals. The desk in front of me is filled with items created by people whose names I will never know. If I had to make these things on my own, I might spend a lifetime and still struggle to obtain them. In fact, some of these objects were crafted by skilled artisans who dedicated years—if not a lifetime—to perfecting their craft. The movie I watched yesterday or the music I am listening to right now has reached this level because someone devoted their entire life to it.

This is possible because of the advancement of division of labor and cooperation. The reason the economy functions well, even without the orders of a dictator, and continues to grow is because of the existence of markets. In other words, markets are the driving force of economic growth.

The phrase “A paradise for aristocrats, a hell for farmers” was used to describe pre-modern Russia. However, this phenomenon was not limited to Russia; it was a global issue. The economy of the past was fundamentally unfair—it was an economy of exploitation where wealth was determined by power. The ancient historian Herodotus once called ancient Egypt a “paradise for farmers,” but Detlef Gürtler, in The History of Wealth, pointed out that Egyptian farmers were actually little more than beggars in rags, living like slaves.

Until the medieval period, wealth belonged to those in power. The wealthiest figures of the past were emperors like Julius Caesar of Rome and Qin Shi Huang of China. In these times, wealth and power were concentrated in the ruling class, and ordinary people had to use their income and labor for the sake of religion or the monarchy. Many of the cultural heritage sites we admire today, such as religious buildings and palaces, might actually be remnants of exploitation.

Military power was economic power, and economic power was wealth. In an era when even a single blade of grass belonged to the king, equality was a luxury. In such a society, economic growth simply meant transferring wealth from one group to another. True economic growth only began when markets developed and the “Age of Merchants” emerged.

Table of Contents

Markets Even in a Prison Camp

The 1953 film Stalag 17 portrays the emergence of a market even in a prisoner-of-war (POW) camp. The story is set in 1944, at the German Stalag 17, a camp along the Danube River, where American Air Force prisoners are held after being shot down in combat. Even in this setting, a market naturally forms—without anyone ordering it to.

The protagonist, Sefton (played by William Holden), demonstrates entrepreneurial spirit by using rats to create a racetrack and even opening a gambling house. He sells betting slips, and the rats are given names like racehorses. In the camp, cigarettes serve as currency, enabling trade among the prisoners.

Despite receiving equal rations of food and supplies, prisoners prefer to trade to improve their well-being. For example, a vegetarian might want to exchange canned meat for jam or margarine.

The laws of supply and demand apply even here. When more prisoners arrive at the camp, food prices rise, and some people profit from these fluctuations. Services such as laundry, portrait painting, and even credit-based financial transactions emerge.

Although external supply remains unchanged, people, through markets, produce more goods and services—and ultimately, they become happier. This demonstrates that job creation is not only about dividing existing work but also about the natural emergence of new opportunities when people interact. True job sharing happens when people recognize each other’s needs and create better products and services in response. Markets facilitate not only the trade of goods and services but also the exchange of ideas and knowledge.

Markets Are the Engine of Economic Growth

Markets exist because they benefit participants. In fact, the development of markets is economic growth. If there is no place to sell, there is no reason to produce more than what one personally needs, and economic growth cannot occur in such a society. For both nations and individuals to grow economically and become wealthy, markets must come first.

Consider the impact of markets on national economies:

- The flower market in the Netherlands

- The insurance and metals markets in the UK

- The financial market of Wall Street in the U.S.

- The grain market of Chicago

Each of these markets plays a vital role in driving economic development.

For instance, the Chicago Board of Trade (CBOT), founded in April 1848, is the world’s largest and oldest futures exchange, handling over 80% of global grain futures transactions. Meanwhile, global capital flows through Wall Street in New York, home to the New York Stock Exchange (NYSE), where major international companies are listed.

Similarly, the Aalsmeer Flower Auction in the Netherlands trades 80% of the world’s flowers. In Japan, the Tsukiji Market in Tokyo gathers seafood from around the globe.

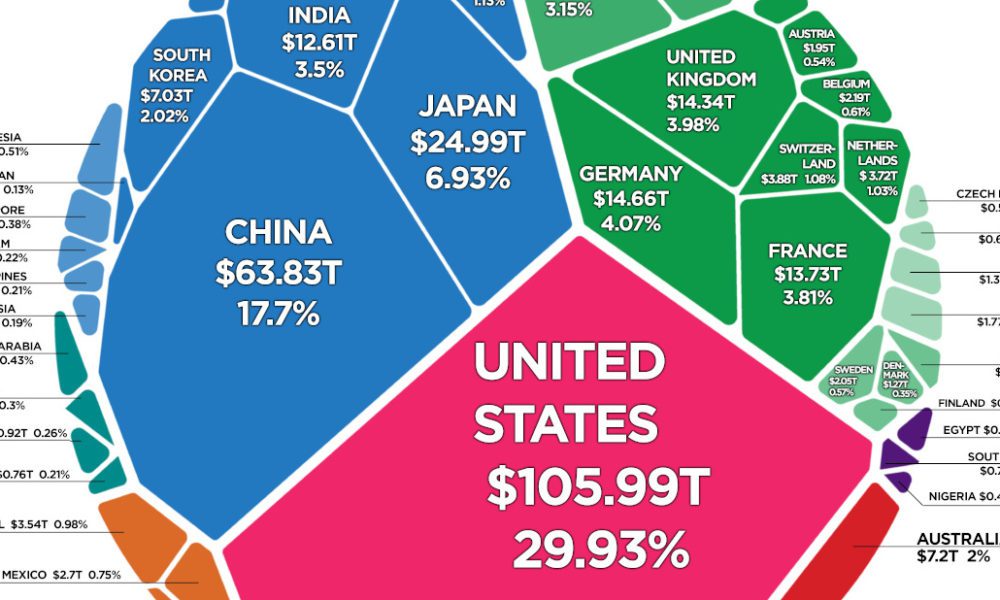

Through the development of markets, countless products and services are exchanged today, generating wealth for humanity. While not all human wealth can be measured in money, as of 2019, the estimated value of private wealth—comprising cash, stocks, real estate, and other financial assets—stood at approximately $360 trillion.

Markets are more than just places of trade; they are the foundation of economic growth, innovation, and prosperity. If we want to create more wealth and opportunities, we must nurture and expand our markets.

The growth of such an economy has progressed alongside the development of the market. The market brings happiness to both buyers and sellers. In fact, unlike business administration, economics does not involve competition in the same way. In that sense, economics can be considered the study of peace. It assumes that through transactions, everyone can be satisfied.

Those with an absolute advantage can simply focus on what they do best and sell it, while even those who may be lacking in everything can still create something based on their comparative advantage—something others are not producing. This holds true as long as one does not feel envious when their neighbor becomes wealthy.

Ultimately, by focusing on what they do best, individuals can produce goods that their neighbors need, bring them to the market, sell their products, and purchase what they need in return.

However, calling economics the study of peace does not mean that competition is unnecessary. It simply envisions competition not as the kind found in business administration, where the winner takes all, but as competition for exchange and trade. Self-interested individuals strive to sell more at better prices to become wealthy, and in doing so, they create superior goods or products that others do not have. In the end, it can be said that the development of markets is what drives economic growth.

답글 남기기