To awaken a society with sufficient potential demand, there must be jobs available. If there is a willingness to work to meet one’s needs and a place to work, production is bound to increase. The increase in production in accordance with demand is what constitutes economic growth.

At one time, it was believed that a nation’s wealth was based on precious metals. This belief, known as mercantilism, posited that the source of wealth lay in rare metals like gold, and that “wealth is money.” However, today many people agree that the source of wealth is “production.” This can be seen in how a country’s power is measured not by its gold reserves or military strength, but by its Gross National Product (GNP) or Gross Domestic Product (GDP).

The individuals who first held this concept were early economists Adam Smith and David Ricardo. They believed that the source of national wealth should be viewed not in terms of the amount of gold stored in warehouses, but rather in terms of productive activities. If there is a given demand, then the amount of production will determine income. Economic growth is a necessary condition for improving people’s living standards.

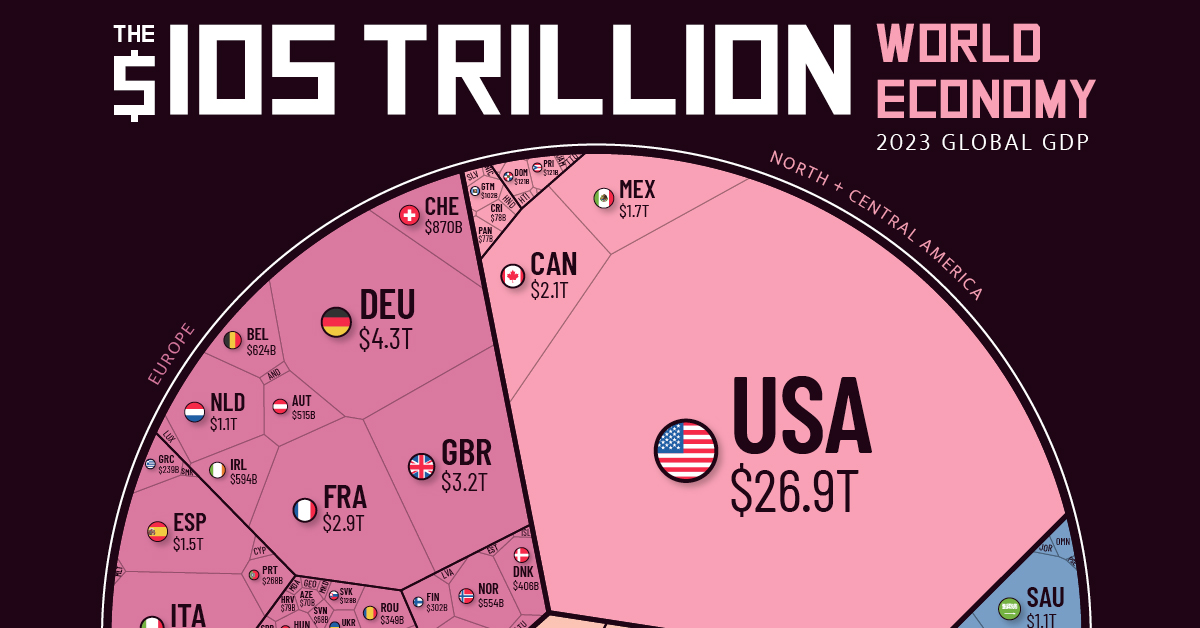

Generally, economic growth literally means the economy is expanding. The extent of economic growth is measured by how much a country’s real GDP, or Gross Domestic Product, has increased over a certain period. Therefore, the phenomenon of increasing real GDP can also be defined as economic growth. When we sum the GDP of all countries around the globe, we arrive at the World Gross Product (WGP).

For reference, GNP refers to the value created by a country’s citizens participating in production activities, while GDP refers to the production that occurs within a country’s territory, regardless of nationality. Thus, the Gross World Product, which is the sum of all production activities on Earth, can be obtained by adding up the GNP of all countries or the GDP, yielding the same result. Dividing this by the world’s total population gives us per capita GDP, which represents the income earned by an individual in a year.

Traditional economics views production as determined by the factors of production: capital, labor, and land. Here, the term capital has a different meaning than what we commonly understand. In economics, capital refers to various assets created by people that are used in production activities, such as factories, machinery, commercial buildings, and housing. Social overhead capital, such as roads, bridges, and ports, is also considered capital.

As the factors of production increase, production rises, and the economy develops. Economic development serves as the driving force for social progress. When the economy develops, citizens not only enjoy material wealth but also experience increased personal freedom and political stability, as seen in advanced societies.

There are various discussions about national competitiveness, but today, a nation’s wealth is generated by competitive enterprises. Simply put, national competitiveness is the sum of the competitiveness of the businesses operating within that country. The total production of a nation is the sum of what these businesses produce. This is what we refer to as GDP, which can be defined by the following equation:

Y = C + I + G + NX

This equation, known as the national income identity, is one of the two formulas we will mention in this issue, so let’s be patient with it. In this equation, Y represents GDP, which is the total value produced in a country over a year. Thus, it can be considered the sum of the value supplied to that society.

On the other hand, the right side of the equation, C, I, G, and NX, shows who consumed how much of the produced value. C (consumption) refers to the value consumed by individuals, I (investment) refers to the value consumed by businesses for investment, G (government spending) refers to the money used by the government, and NX (net exports) refers to the value consumed by foreigners, calculated as exports minus imports. In other words, what is produced in a country is either consumed by individuals, reinvested by businesses, spent by the government, or exported for consumption by foreigners. If foreigners purchase goods from that country, it means foreign money is present in that economy, akin to saving foreign currency.

To summarize, Y represents production, or supply, while C, I, G, and NX represent demand. Of course, this is the outcome. We will use this equation to explore the differences in various claims made by economists and specifically seek answers to the question, “Why have some nations become wealthy while others remain poor?”

Certainly, the factors determining a nation’s economic growth are numerous, with scholars having identified over 60 different elements, making it a complex issue.

First, let’s examine how a nation can increase Y, or GDP, to grow its economy. The production for the following year can be thought to be fundamentally determined by the investments made in the current year. In the equation above, that investment is represented by I.

However, in this equation, I refers only to visible investments, such as machinery, factories, and tools. Traditional economists assumed that production methods were fixed. Therefore, to increase production, the units of input must also increase. These input factors can be categorized into three types: physical resources, human resources, and technological resources.

Yet, production can also yield remarkable results through invisible resources.

For example, if new ideas or technological innovations occur, production in the following year can significantly increase, regardless of the size of I in the equation. The GDP for the next period is determined not only by the I shown in the simple national income equation but also by these invisible factors. The fact that resource-poor Northeast Asia has achieved faster economic growth than resource-rich Southeast Asia or Latin America illustrates this point.

Thus, the path to becoming wealthy is not straightforward, and there is no consensus among scholars. However, we can simplify it into three elements: physical technology, social technology, and commercialization technology. The growth of enterprises can be relatively easily explained through these methods.

Physical technology concerns how efficiently physical resources are used, while social technology pertains to how human resources are utilized. From a business perspective, physical technology relates to production, while social technology pertains to human resource management. On the other hand, commercialization technology can be seen as the ability to combine physical and social technologies for business purposes. This relates to business planning and includes issues of business models and marketing.

Historically, the decisive factor in economic growth has undoubtedly been technological advancement. The rapid economic growth since 1750 coincides with the great technological leap of the Industrial Revolution. However, the evolution of technology is just one part of the story. Evolutionary economist Richard Nelson emphasizes that there are two types of technology that play a major role in economic growth, and that these co-evolve.

The process from the stone wheel to the automobile, airplane, and spacecraft represents the evolution of physical technology, which falls within the realm of natural sciences. The emergence of markets, the invention of money and double-entry bookkeeping, the development of joint-stock companies, and the formation of capital markets, all starting from small family units for hunting and farming, represent the evolution of social technology, which belongs to the domain of social sciences. The basic elements of biological evolution, genes, can be seen as the collection of knowledge that constitutes “commercialization technology” in economics.

While physical technology has undoubtedly had a tremendous impact on society, the contributions of social technology are equally important, and in fact, the two co-evolve. For instance, during the Industrial Revolution, Richard Arkwright’s invention of the water frame was a physical technology. This physical technology led to the development of social technologies that efficiently organized and deployed people to operate large factories, which in turn gave rise to physical technologies that applied steam and electricity to manufacturing. Ultimately, economic growth occurs through the mutual influence and co-evolution of physical and social technologies.

답글 남기기