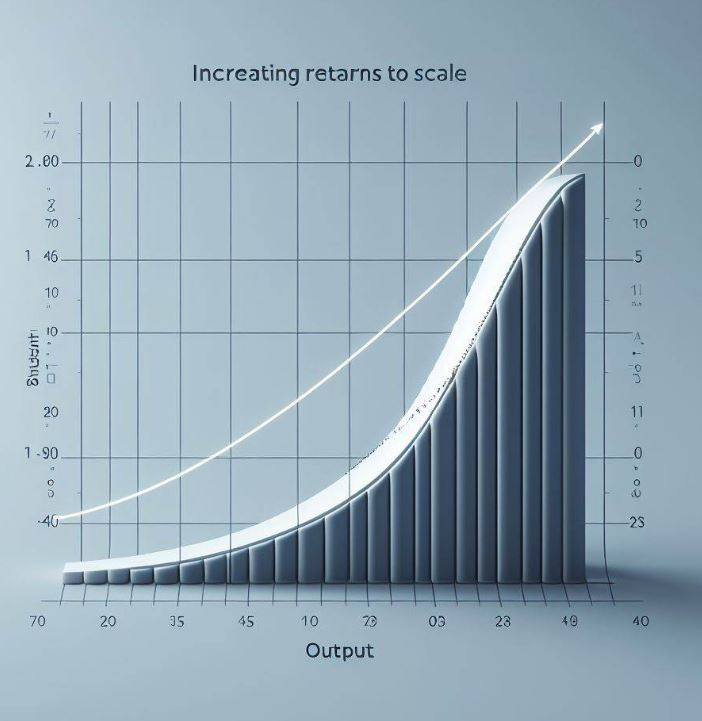

The Law of Increasing Returns to Scale in economics is defined as the phenomenon where the marginal output increases with each additional unit of input. When the Law of Increasing Returns to Scale is in effect, increasing inputs such as capital or labor leads to larger production scales, which in turn reduces costs and increases profits. For example, if one person can produce one bicycle per day, two people might be expected to produce two bicycles, and three people, three bicycles. However, the Law of Increasing Returns to Scale suggests that two people might produce three bicycles, and three people might produce five bicycles, indicating an improvement in productivity.

As this effect continues, a company’s size, scope of operations, and customer base expand, leading to increasing profits. When a company reaches a certain level, it becomes difficult for new competitors to catch up due to the lower costs and increased profits associated with larger scales of production.

Increasing Returns to Scale also leads to a situation where those who are already ahead gain more, further extending their lead, while those who are behind find it increasingly difficult to catch up. This phenomenon can create a “lock-in” effect, where those who happen to move ahead early on due to chance can fortify their advantages, preventing other competitors from entering the market. In essence, it intensifies inequality.

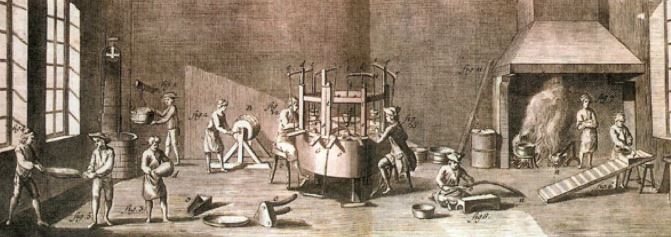

Why does this occur? A key factor is the division of labor coupled with collaboration. Collaboration refers to working jointly, while division of labor means assigning different tasks to different individuals. Even a basic division of labor, which doesn’t depend on the unique skills or abilities of workers, can significantly boost productivity. Adam Smith illustrates this in “The Wealth of Nations” with an example from a pin factory. When the pin-making process is split into different stages among ten workers, they can collectively produce approximately 48,000 pins in a single day. However, if one person were to manage all these stages by themselves, they would only manage to produce 20 pins. This scenario demonstrates that division of labor can enhance productivity by up to 240 times.

This tremendous increase in productivity, where does it come from? Fundamentally, it comes from saving time, as the time taken to switch from one process to another is reduced. As individuals become more skilled at their tasks, productivity will further increase. Moreover, consider if everyone were to do what they are best at. There are certainly tasks that people are naturally better at depending on their personalities. Some people are adept at delicate tasks, while others are physically stronger than the rest. There are those who excel in singing and those who are skilled in design. It seems obvious that productivity can be increased through collaboration. Adding the joy derived from working together, cooperation in human society becomes an indispensable way of life.

The benefits of this division of labor increase as production scales up. A principle known as the ‘law of mass production,’ was mentioned in a paper published in 1910 by the German historical school economist Karl Wilhelm Bücher. According to this law, as production volume increases within a certain scale of production facilities, the average cost per unit of product decreases. Microsoft invested $50 million to create Windows. The cost to produce the first piece of software was $50 million. However, the cost to produce a second item was only an additional $3. The average cost for these two disks would be $25 million and $1.50. As production increases, the cost per unit will continue to decrease. If 100 million units are produced, the production cost per unit would be $3.50.

Furthermore, large-scale production leads to reduced material costs and transportation costs. Cost savings also occur in other aspects unrelated to production. For instance, financing becomes easier, and marketing costs can be reduced. All these phenomena can collectively be described as a synergy effect. This means 1 + 1 is not simply 2. Originally, synergy refers to the interaction where muscles or nerves in the body work together to enhance overall effect. The term synergy derives from the ancient Greek word ‘Synergos’, meaning ‘working together’, and indicates a phenomenon where the interaction between organizations, drugs, or individual situations results in an overall effect that is greater than the sum of individual effects.

In fact, we have been mixing two different materials to create a better composite material for a long time. One of the oldest examples of synergy might be bricks made from mud mixed with straw or grass, which significantly enhance the strength of the bricks. Creating more useful materials through alloys is also a good example. This development continues with aircraft bodies and wings made from duralumin, an alloy containing aluminum, copper, magnesium, manganese, and silicon. Efforts are ongoing to create better synergies by mixing carbon fibers, producing a composite material where the strengths of carbon fibers and plastics complement each other, resulting in a strong synergy effect.

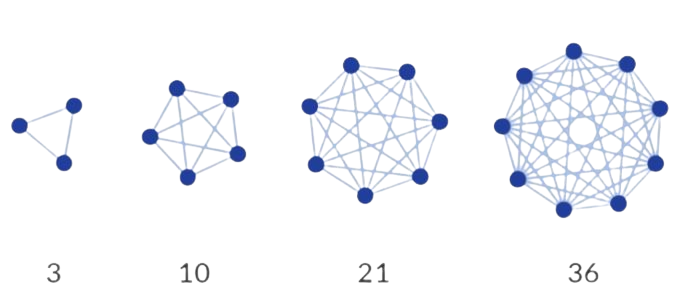

Synergy effects can prominently occur in chemical reactions but can also be observed in physical phenomena. For example, if one horse can pull a one-ton carriage, two horses should be able to pull a two-ton carriage. However, experiments have shown that they can pull more than two tons. Thus, when two or more different entities combine their strengths, they can produce a force greater than the simple sum of their individual strengths. Such synergy effects can accelerate increasing returns, known in networks as Metcalfe’s law, which states that the value of a network is proportional to the square of the number of its participants. For instance, if I’m the only one among my friends who owns a cellphone, it is hardly valuable. But as my friends gradually buy cellphones, the utility of the cellphone rapidly increases. This increase in value primarily occurs when two-way communication is possible, such as with telephones, fax machines, and the internet.

Organizations with an evolving mindset and learning capabilities can also experience increasing returns through network laws. When new information is added to existing data, a synergy effect occurs, creating even more valuable information. For example, an expert with extensive consulting experience can quickly generate the knowledge that a client needs. Furthermore, new information and knowledge will accumulate for this expert through consulting experiences with new clients, positioning them advantageously to generate new knowledge faster than anyone due to the synergy between this information.

From the supplier’s perspective, the synergy effect of production factors leads to cost reduction and increased productivity, which gives rise to the law of increasing returns. Conversely, increasing returns can also occur due to consumer characteristics. Economists refer to this phenomenon as the network externality or, more briefly, the network effect. Simply put, the network effect describes a situation where the more users there are, the more people will use the service, amplifying the product’s value not just based on quality but on the number of current users. As more people use a product, convenient network effects such as compatibility emerge. The importance of compatibility between products means that a consumer’s choice of a specific product is influenced not only by the product’s quality but also by the number of existing users.

In economics, an externality is colloquially known as an ‘unexpected effect’. An example of an externality could be a beekeeper located next to an orchard. The beekeeper can produce more honey but does not pay the orchard owner. Such externalities exist even within an unenclosed network economy.

Marketing phenomena such as the penguin effect or the bandwagon effect in economics are just different expressions of such externalities. People tend to purchase products or services deemed popular by many others first. This is evident when people consider bestsellers when buying books or frequent crowded restaurants for dining out.

Furthermore, once consumers become accustomed to a product, even if an innovative product appears, they tend to stick with the existing product if it dominates the network. This is known as the lock-in effect. A rational interpretation could consider the consumer’s switching costs. The learning effect is another term for this phenomenon. Besides the direct costs of switching, there are costs associated with the time and effort required to become accustomed to something new. Compatibility and standards issue also contribute to the lock-in effect.

Even if Microsoft Office is not the best program, many people use it because it is compatible, leading others to adopt Office. This creates a standard. Even if someone familiar with Office finds a new software that is slightly better or cheaper, it may not be easy to switch.

The law of increasing returns is a phenomenon created jointly by sellers and buyers. In situations where this law applies, intense competition can lead to a winner-takes-all scenario, a phenomenon we discussed in tournament-style competitions and a cause of operational inequality laws.

From a societal perspective, this could be a cause of inequality, but from the competitors’ point of view, it is a primary factor to consider in strategy.

The rationale for corporate mergers and acquisitions and the importance of industry clusters also stems from the utility of synergy effects. An industry cluster refers to the gathering of related companies or organizations in a specific field through network synergy. For example, the film industry is clustered in Hollywood, advertising agencies in Madison Avenue, and luxury watches in Geneva, enhancing competitiveness.

답글 남기기